RBI urges government to cut rates on small savings schemes

Times of India 10/12/2019

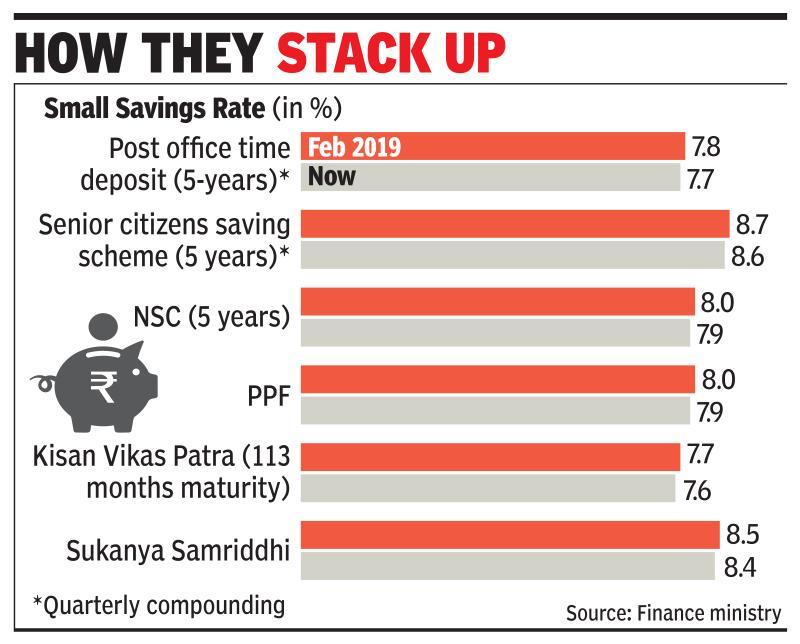

NEW DELHI: The RBI has urged the government to move forward on reducing interest rates on small savings schemes such as public provident fund (PPF) and post office deposits, to help banks pare rates on deposits and loans and lead to a better transmission of the central bank’s rate cuts.

The central bank believes that a reduction in rates on the small savings schemes, which were left unchanged by the government when they were last reviewed at the end of September, will enable banks to cut deposit rates that have been sticky as banks do not want to lose out on deposits.

Since February, the RBI has reduced policy rates by 135 basis points (100 basis points equal a percentage point) to lower the cost of funds for borrowers and increase demand for loans.

But on an average, banks have reduced deposit rates and the one-year marginal cost of lending rate (MCLR), the benchmark for most loans, by around half-a-percentage point each, prompting the RBI to hold rates steady during the last review in the expectation that the earlier reduction will be passed on by banks. SBI has reduced interest rates on its two-three year fixed deposits by 55 basis points since February and now pays 6.25%.