In this week’s cover story, we tackle seven misconceptions about money that if ignored, can jeopardise your finances. From telling you why not all long-term loans are bad to how much of risk you ought to be taking; from looking beyond just the monetary aspect of retirement planning to pointing to the dangers of over dependence on your financial adviser; from hammering home the point that SIPs do not make your investment risk free to why it is not necessary to budget for every paisa; we tackle the harmful myths doing the rounds to ensure a secure future for you.

Myth 1: Pay long duration loans first

A common trait among many finance professionals is to recommend paying off of long duration loans quickly to save on interest costs. While on the face of it the logic appears sound, the folly lies in not considering the time value of money. What the financial advisers are doing is equating the interest saved now with interest saved after say a decade.

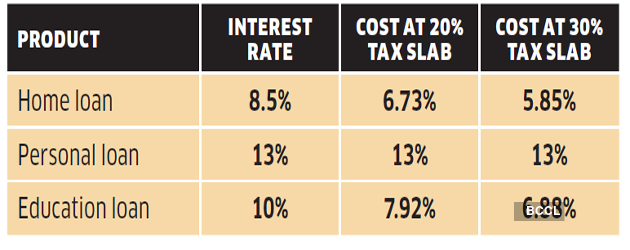

The fallout of such advice is people continue to service high-cost short-term loans like personal loans while prepaying low-cost long duration loans like housing loans. “Instead of paying long duration loans blindly, borrowers must compare the net cost of borrowing— after considering taxes— and repay the most expensive loans,” says Rohit Shah, Founder & CEO, Getting You Rich. Tanwir Alam, Founder & CEO, Fincart agrees. “If you consider tax benefits, the real cost of a housing loan will be less than 6% for people in the 30% tax bracket. It is a mistake to repay that and not the personal loans, which cost much more,” he says.

This argument makes immense sense to home loan borrowers. A home loan of Rs 50 lakh at 8.5% can be made tax efficient by taking the loan in two names—of the husband and wife. Due to tax benefits under Sec 80E and the reasonable cost structure, an education loan is another long duration good loan that borrowers should not rush to repay (see table).

Irrespective of tenure, prepay most expensive loans first

Effective cost of different loans

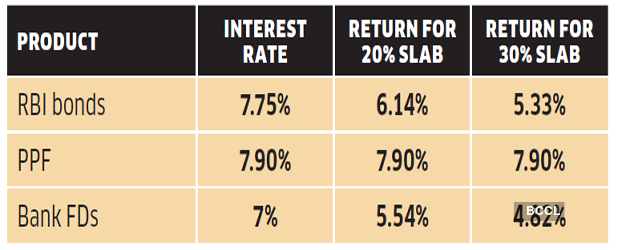

Should you prepay loans or invest the amount elsewhere? “Consider investment over repayment if the post-tax investment return is higher than the tax adjusted cost of loans,” says Alam. Returns of tax-free products like PPF are higher than tax adjusted costs of home or educational loans (see table).

If investment returns are higher, let loan run and invest elsewhere

Effective return of different investments

Due to impact of 4% cess, effective slabs now are 20.8% and 31.2%

Myth 2: Risk is not for the middle class

This myth warns the middle class to avoid risk at all cost. However, shunning risk now can have serious repercussions in future. This is because this income group has limited resources and will not be able to meet goals by relying on low risk and low yielding debt products alone. In other words, investors from this group must park a part of their portfolio in growth assets like equities that can generate higher returns. “People with limited resources can’t afford to ignore equity. Else, inflation will eat into their corpus. The only question is how much this equity allocation should be,” says Suresh Sadagopan, Founder, Ladder7 Financial Advisories.

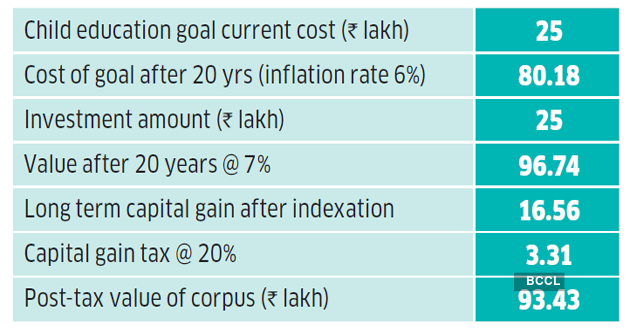

On the other hand, high net worth individuals (HNIs) can ignore equities and remain fully invested in debt if they want to, without affecting their goals. Let us assume the higher education goal of two children– one from an HNI family and another from a middle class family. After 20 years both will need a corpus for a two-year course that costs Rs 25 lakh now. If inflation remains at 6% per annum, the required amount will be Rs 80.18 lakh. The HNI family can make an upfront investment of Rs 25 lakh in safe products like debt funds, which can generate a CAGR of 7%. The return will be enough to meet the goal.

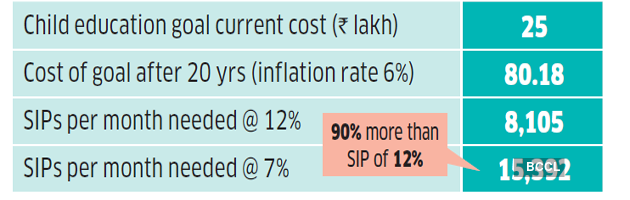

However, a middle-class family, if it tries to achieve this goal through a safe route, will be forced to invest much more. To accumulate Rs 80.18 lakh after 20 years at 7% return, the family must do a monthly SIP of Rs 15,392. The SIP amount can be Rs 8,105 if the product can generate a return of 12% per annum, which is possible from equities.

Middle income investors will find it difficult to reach goals if they avoid investing in equities out of fear.

Why HNIs can remain invested in debt alone

For middle income group cost is much higher

Myth 3: In the long term, SIPs are risk free

While all finance professionals say SIPs average out investments and thereby reduce risk, some go overboard and try to project SIPs as the weapon to eliminate risk altogether. “SIPs will never able to eliminate risk because it is just a tool and not a product,” says Amol Joshi, Founder, PlanRupee Investment Services. Though SIPs can be done for any asset class like equity, debt, gold, etc., most investors use it for equity funds. “Equity returns will never look linear, whether the investment is done through SIPs or one time. A casual look at the last 20-year returns will show a few good, bad and average years,” says Alam.

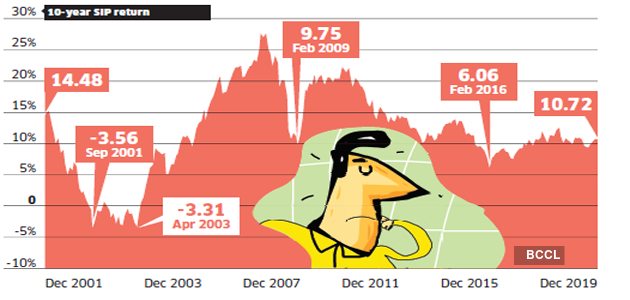

Since the returns from a few good years will compensate for the bad years, equity investors end up getting decent historical average returns. However, long term SIP investments can also give negative returns if the stock market remains in a bear grip over a very long time. Despite long term SIPs, returns were negative when the market hit rock bottom between 2001-03 (see chart).

SIPs can generate negative returns if stock market goes into a prolonged bear phase

This is not an attempt to undermine the importance of SIPs. On the contrary, SIPs are an important tool for every investor. Only the myth that SIPs make equity investments risk-free needs to go. In addition to averaging purchases, SIPs are suitable for people who earn regular monthly income as it helps them coincide their earnings with investments.

Myth 4: Retirement planning is all about money

This myth grew as discussions about retirement planning centred around creating the retirement corpus. While most people underestimate the longevity risk or the risk of surviving long years and exhausting the retirement corpus, creating an adequate corpus that will last till the end is the corner stone of retirement planning. However, retirement planning should also take care of several other issues.

Time in hand is the biggest asset (or liability) in retirement, depending on which way you look at it. “Since retired life can stretch to 30-40 years, you need to balance the money part with other activities. Use a part of the free time to revive hobbies, rejuvenate the friends’ circle and spend time on social responsibility etc,” says Joshi. Sadagopan agrees with him. “We ask clients to treat retirement as a new innings and think about the non-financial aspect too,” he says.

Managing health related issues is the next big task in retired life. Retirement planning should be split into two parts— the time till you expect to maintain reasonable health and beyond. Retirement planning should also have a clear plan in place for the second stage when you require support. If you are not sure of the support of your children, it is better to identify retirement homes from now itself. What should be the criteria while selecting retirement homes? “While selecting retirement homes, basic facilities like medical care, etc. needs to be fulfilled. However, the final decision should be based on location,” says Anil Lobo, India Business Leader – Retirement, Mercer.

Myth 5: The family budget needs to be detailed

We tend to avoid seemingly complicated tasks and budgeting is one of them. The myth about must having a detailed budget in place needs to go. Not creating a budget because you can’t make a detailed one is foolish. There is nothing to stop you from creating a family budget with broad guidelines. “Budgeting doesn’t mean that you have to write down everything. Treat budgeting as a broad framework and split the outflows into three buckets—expenses, repayments and savings,” says Joshi. What is there in each bucket will vary depending on life stages and income levels. For example, expenses will be less than 1/3 for families with very high incomes. Similarly, the repayment buckets will be empty for people without any loans.

Split your outflow budget into 3 broad categories for better control

Family budget for outflows

Bucket 1: Expenses

Bucket 2: Repayment

Bucket 3: Savings & investments

To identify how much should be in each bucket, identify your broad expenses first. “Identifying expenses is not that difficult and if the husband and wife sit together, they will be able to do it in 15-20 minutes,” says Sadagopan. This is because most monthly expenses like electricity bill, telephone bill, etc are paid online and therefore, easy to track. Most groceries and other household expenses are bought using credit cards now and trail is available there too. What they need to discuss and finalise is a budget for discretionary expenses like eating out, movies, etc. and annual expenses like travelling, etc. While budgeting, one also needs to make provisions for random expenses like replacing appliances that may come up during the year.

Myth 6: Straying from budget will upset financial plans

If you repeatedly fail to stick to your budget, you will impact your long-term goals. However, budgets are broad guidelines and overshooting every few months is normal. If there is a budget breach, find out from which bucket you have spent excess from. For example, meeting your sudden urge to buy a smartphone by giving up on the annual travel plan is fine. However, there would be a problem if you bought the phone by breaking into investments for critical goals like your kid’s education or your retirement planning.

A budget breach can also happen because of sudden and necessary expenses. For example, you want to gift a gold chain for your relative’s marriage because she did the same for your marriage. You can dip into the emergency fund for situations like this. “The emergency fund is not just for bad things like hospitalisation and loss of job. It can also be used for other necessary expenses that come up suddenly,” says Alam. However, make sure you don’t touch the emergency fund for expenses that can be postponed, like buying a smartphone.

If the emergency fund is not enough, you can also manage immediate cash flow stress by stopping SIPs for a few months and restarting it later. For example, stopping SIPs for a few months will be a much better option than making cash withdrawals from a credit card. However, some people are reluctant to restart a stopped SIP and this behaviour can create problems for long term goals. If you are in this category, you need to make your budgets flexible. “Leave some cushion in the budget itself and don’t over commit with your monthly SIP amounts,” says Vikram Dalal, Managing Director, Synergee Capital Services.

Myth 7: The financial adviser will take care of it all

Most investors assume that once they hire an adviser, their financial planning related work is over. What investors should understand is that planning is just the starting point and not the end. “We take clients’ input in everything and explain the possible scenarios to them. After that, it is their decision,” says Sadagopan. It is also not safe on the part of investors to blindly trust advisers. Investors should always remember the ‘caveat emptor’ rule. “Investors handing over the logistic part to the adviser is fine, but they need to keep the decision-making part with them,” says Shah.

Please note that appointing someone as your financial adviser itself is a big decision and you have to do proper due diligence. Even after that, investors need to drive the engagement with the adviser and keep questioning them. As per the Sebi RIA rules, active involvement from the client is compulsory.